Early Elections and Mortgage Madness

How rising rates will further damage Conservative prospects in key areas

Mortgages are back on the political radar again, with news today that average rates are approaching 6.5% this quarter, and last week the suggestion that Rishi Sunak may be tempted into calling an early election this year to avoid the worst of a looming lending crisis.

If the prime minister does call the electoral machines to battle sooner rather than later, the theory goes, the Conservatives might avoid fighting Labour on even more unfavourable financial ground as mortgage rates climb to their (predicted) peak next year.

But why do increasing rates matter? And why should mortgage holders be of such concern to Sunak and the Conservatives – or, equally, to Starmer and Labour?

Others have written extensively on this ‘aspiring’ group of most-often middle class, younger-to-middle aged, financially stable, career and family driven voters constituting this segment of the population in 21st century Britain.

These are exactly the sort of floating voters who twist and turn and tend to decide British elections.

The geography of a crisis

But there is another string to mortgage-holder bows, making them an extra important slice of our current political pie: namely, electoral geography.

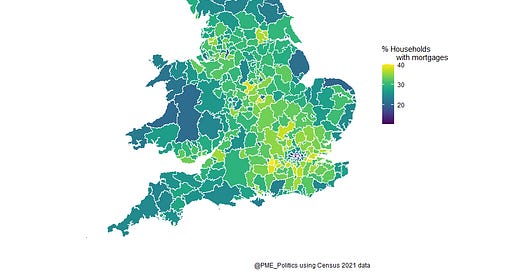

The map below shows the percentage of households with a mortgage in English and Welsh lower tier local authorities, according to the 2021 English and Welsh census.

Immediately, we are drawn to the sea of yellow surrounding London and stretching up into the West Midlands. These are the authorities with the highest proportions of mortgage holders – some reaching as high as 40% of households in the council area.

What is so special about this region of constituencies, from an electoral geography perspective? You know it, of course – it’s almost completely covering the Blue Wall.

The Blue Wall is collection of around 50 Westminster parliamentary constituencies currently held by the Conservatives, but which voted to Remain in the 2016 EU referendum, have higher than average degree holders, and have also recently been the scene of utter decimation for the Tories at local authority elections.

Houses are more expensive here, but the pleasant suburban, family-friendly lifestyles mixed with easy commutes to London attract many of exactly the sort of people we would expect be at the ‘has a mortgage’ stage of life.

In fact, the highest proportion of mortgage owners in any local authority in England and Wales is Wokingham, at 40% (the England and Wales median is 28.1%). The parliamentary constituency covering that area is one of the Liberal Democrat’s top, top Conservative-held targets for the next General Election.

Notice how dark the areas on the map are where the safest, most rural Conservative constituencies sit? Namely, the East of England and the South West.

But why does it matter if the Blue Wall – or any other area of electoral competition – is stacked with mortgage holders?

Well, if a huge proportion of voters in a given constituency are applying for or renegotiating mortgages around about the time of a general election and are faced with sky-high rates at levels not seen since the 1980s, they aren’t likely to reward the governing Conservatives for the financial pain that will cause them.

Just as Sunak and the Conservatives have maybe started believing that the prime minister’s ‘steadying the ship’ economic messaging and policy platform might be yielding some results, they may well be struck with a ghastly blow from the ghost of prime ministers past (namely, Liz Truss).

Hence, the early election theory.

Will the Red Wall see red?

Looking elsewhere, the stretch of yellow and light green up toward the West Midlands, and the band of the same colours reaching across from Merseyside to East Yorkshire, blankets a large range of marginals and historical bellwethers which will be crucial to the outcome of the next general election.

The local authorities of South Derbyshire (38.3% mortgage holders), South Ribble (36.1%), Tamworth (33.7%), Rossendale (33.3%) Bury (32.5%), and Bolsover (30.8%) all contain vital parliamentary battlegrounds, and have significantly higher rates of mortgage holders than the national average.

Many areas shaded in those lighter colours also cover an infamous set of constituencies which are also currently proving extremely difficult territory for Sunak and the Conservatives – the Red Wall.

Coined by James Kanagasooriam ahead of the 2019 parliamentary election, the definition of this collection of seats has expanded somewhat since then to generally capture the Leave-voting areas of the North and Midlands represented by Labour MPs ahead of that election.

Many of them now of course feature Conservative incumbents following Boris Johnson’s thumping 2019 victory, and will be a crucial part of any attempt by Sunak and his party to try defend their parliamentary majority.

There is also a great degree of variance to the connection between mortgage holding and electoral competitiveness within local authorities, too. Including within local authorities we would consider part of the Red Wall.

Zooming in on the North East of England, we see comparatively low rates of mortgage holding in the densest urban areas (including heavily Labour voting Newcastle, for example) and the more rural areas such as Berwick-upon-Tweed and Hexham in the north and and the western reaches of Northumberland further south (where support for the Conservatives is stronger).

Of course, it must be said that higher mortgage rates do not only effect those holding (or apply for) mortgages; anyone renting a property for which their landlord holds a mortgage will be at risk of also feeling the impact in terms of rent rises. They will most likely be found in those more urban, Labour-supporting areas.

But buffering these dark blue areas of urban sprawl and rural ridings are the greens and yellows suburban and semi-rural swathes, where we find many more mortgage holders.

Some of these areas have rates so high in fact that four wards in the region have more than half of all households owning their property with a mortgage.

The highest rate can be found in the Ingleby Barwick West ward (59.6%) in the Stockton-on-Tees council area, followed by Wheatlands in Redcar and Cleveland (54%), and then Northern Parishes (51.9%), again in Stockton-on-Tees, and Stainton and Thornton in Middlesborough (51.9%).

The lowest rates of mortgage holders are Arthur’s Hill within Newcastle upon Tyne (6.3%), Elvet and Gilesgate in County Durham (9%), Monument (9.1%) and Elswick (9.7%) in central Newcastle, and Newport in central Middlesbrough (10.6%). All very urban.

Is anywhere as safe as houses for the Conservatives, now?

Whichever way you cut this particular cake, he evidence is clear – in terms of the geography of the coming mortgage storm, suburbia, the Blue Wall, and township England will be hardest hit. And that is bad news for Sunak.

The Conservatives cannot afford to lose heaps of voters in suburban England at the next general election, with so many Conservative seats to defend in exactly those of areas if they are to deny Labour a majority.

Many towns - particularly in the Red Wall - are increasingly turning their backs on the Conservatives. There is immense frustration in these areas around what are perceived to be unfulfilled promises on local improvements, economic mismanagement and the rising cost of living, and breaking down of trust over ‘partygate’ rule breaking.

And we know very well that Blue Wall voters are already abandoning the Conservatives in their droves in local authority elections. We can’t be certain if these patterns will replicate at a general election contest, but higher mortgage rates will certainly not help in bringing them back into Conservative the fold.

On the other side, Keir Starmer and Labour are making clear pitches to voters both in the Red Wall and also in suburban areas and towns right across the country. A full blown mortgage crisis will give the voters there even more reason to shift in Labour’s direction and solidify their polling lead.